VeChain - Whitepaper Summary - 114 Pages of Gold

A post by Narayani Modi

As Recommended by Cointify exclusively on Telegram.

The highly anticipated whitepaper of VeChain was released yesterday.

With all the anticipation surrounding their whitepaper, community sure was waiting for this and boy have they delivered. With 114 Pages of goodness and understanding, both for technical and an average joe, is why I am heavily invested in VeChain (Both Financially and Intellectually). The paper sure seems to be a lengthy and YES, IT IS. But, don’t be intimidated by its length, it is really well written for those without an advanced understanding of blockchain and cryptocurrencies. Even if you skip some of the mathematical sections if you must, you will learn an amazing amount about the project by giving this a read. Regardless of what you hold, I think what VeChain is doing should excite everyone that wants blockchain tech to succeed.

Since, not everyone can allot time to read 114 pages of a whitepaper, that’s why I’m bringing you this summary. It summarizes the whole whitepaper in simpler terms so that every member in the crypto community can get the idea of what they wanted to convey with the whitepaper and better understand the future potential of VeChain. Still, I highly encourage everyone in the Crypto space to read this white paper. I have read dozens of white papers and VeChain has taken it to a whole new level. It clearly states a solid understanding of the past, present and future technical and businesses development.

This summary comprises of pointers for more focused reading and understanding of the entire whitepaper. So, HERE WE GO.

Preface

- Blockchain X — VeChain has been able to design a complete, holistic blockchain with the governance structure, token economics, regulatory compliance, and community ecosystem to continually and incrementally evolve the blockchain protocol to absorb any innovation and satisfy the needs of the community, investors, enterprise clients, and academic and governmental partners. In this regard, VeChainThor will be Blockchain 3.0, 4.0, 5.0, etc. For this reason, they refer to VeChainThor not as Blockchain 3.0, but as Blockchain X.

- Token Split — With the mainnet launch’s token swap, VeChain will conduct a 1:100 coin split. At that time, every 1 VET owned will be exchanged for 100. As a result of the coin split, the requirements for VET allocation in all nodes will also increase by a factor of 100. More details can be found in later sections.

- Vision (Enterprise Focused) — T he vision of VeChain and the VeChainThor Blockchain is to build a trust-free and distributed business ecosystem platform to enable transparent information flow, efficient collaboration, and high-speed value transfers.

- Creation of a robust Distributed Business Ecosystem comprising of Business owners, Application Service Providers, Smart Contract Providers, Infrastructure Service Providers, VeChain Foundation and VeChain Community.

Governance Model (A balance of Decentralization and Centralization)

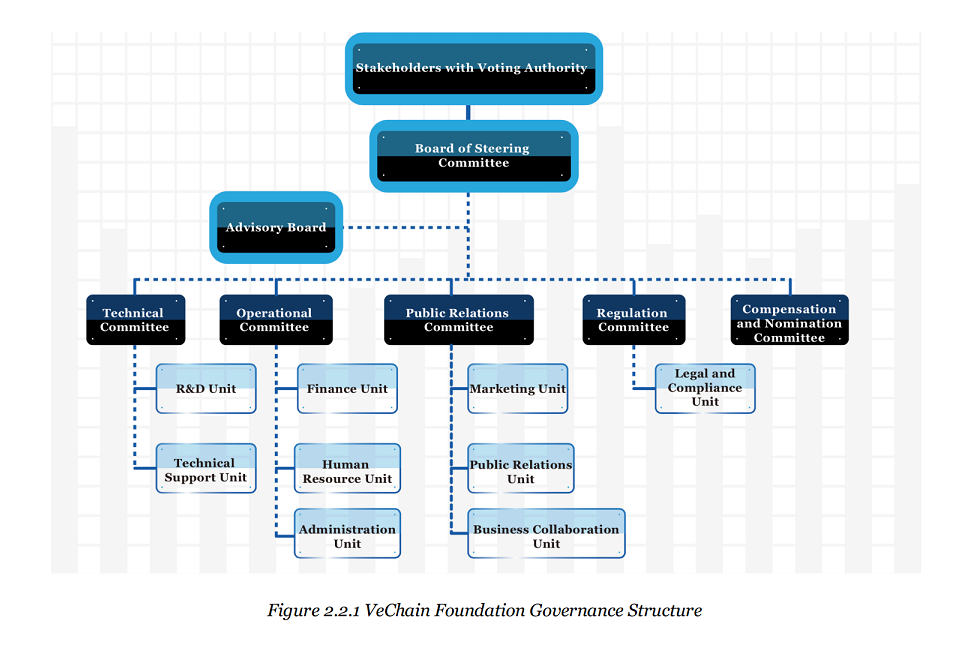

The governance structure and principles are designed for visibility, inclusiveness, transparency, flexibility and efficiency. They are designed to facilitate the development, innovation, coordination and advancement of the VeChainThor Blockchain ecosystem.

- The Board of Steering Committee is the governing body of the VeChain Foundation. It is selected by identifiable stakeholders with VET Voting Authority (VET Masternodes). The Steering Committee lays out the critical strategies and selects functional committee chairs to oversee the operational units of the Foundation.

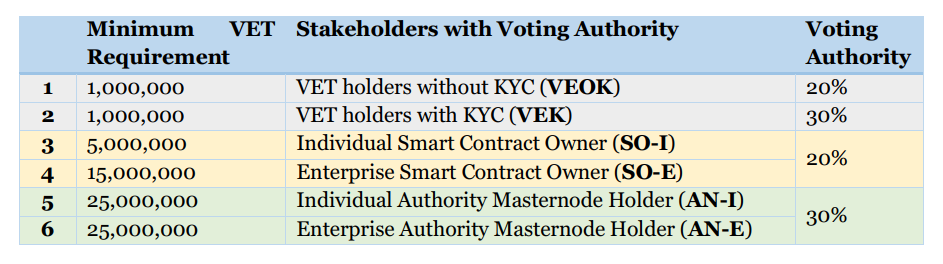

- Stakeholders — the stakeholders are the VET holders and some of them have specific roles such as Smart Contract Owners and Authority Masternode holders. Each of the stakeholders hold voting rights calculated by the voting authority model.

- Table summarizing the minimum VET holding requirement for each category of stakeholder and their corresponding voting authority (after mainnet launch and 1:100 token split).

4. There are 101 active Authority Masternode holders on the VeChainThor platform.

5. General Voting — Fundamental subjects that will be voted by the stakeholders acc. to their Voting Authority:

a) The election of the new Board of Steering Committee;

b) The modification of the fundamental consensus mechanism or technical parameters; and

c) Other subjects that the Board of Steering Committee deem necessary for general voting.

6. The general voting activities shall use the VeVote service, designed to ensure anonymity, accuracy and make manipulation impossible.

The Board of Steering Committee

- The Steering Committee is the governing body of the VeChain Foundation. They define the important strategies and select functional committee chairs to oversee the operation of the Foundation.

- The Board also recognizes the important role the Foundation plays in the blockchain ecosystem and the importance of providing active governance, designed to ensure the safety and soundness of the operations within the VeChainThor Blockchain. The Board is responsible for establishing the general oversight and framework, including the design of the operating rules of the blockchain, intended to achieve the goals.

- Size of the Steering Committee — The number of committee members will be determined from time to time by the Board, ranging between 7, 9, 11 and 13.

- Term — The term for the Steering Committee is two years fixed.

- Nomination — The nomination committee (includes Steering Committee) can nominate up to 3 candidates (for the election of a new board with

the same size) or 5 candidates (for the election of a new board with an increased size). - Number of Board of Steering Committee Meetings — The Board shall hold a minimum of four scheduled meetings per year.

- The Board has established the following functional Committees as well: Technical; Operational; Public Relations; Regulation; Compensation; and Nomination.

Economic Model and Design

Problem in existing economic model — The largest obstacle to adoption of massive applications on blockchain: the cost of using blockchain is directly linked to token valuation. While the token valuation usually goes up as the volume of use in the blockchain ecosystem increases, the cost of using blockchain dramatically varies.

Dual Token System — VeThor Token (VTHO) and VeChain Tokens (VET)

- VTHO is generated via holding VeChain Tokens (VET), which is established to enable any user with VeChain Tokens (VET) to make transactions at no extra cost if the user holds the tokens for long.

- The function of VET is to serve as value-transfer medium, or in other words, smart money, to enable rapid value circulation within the ecosystem based on VeChain. On the other hand, VTHO represents the underlying cost of using VeChain and will be consumed (or, in other words, destroyed) after certain blockchain operations are performed (smart contracts, dApps etc.).

- According to thedesign, VeChain will generate one block every 10 seconds. For 10K VET there will be 4.32 VTHO generated every 24 hours (1 VET held (0.000432 VTHO Power a day).

- The design of the Twin-Token model intends to maintain some sustainable transaction cost of using VeChain Blockchain. Depends on the market participation of the VTHO market and the demand and supply of VTHO, the Foundation would adjust the minimum price of VTHO per gas to achieve its goal.

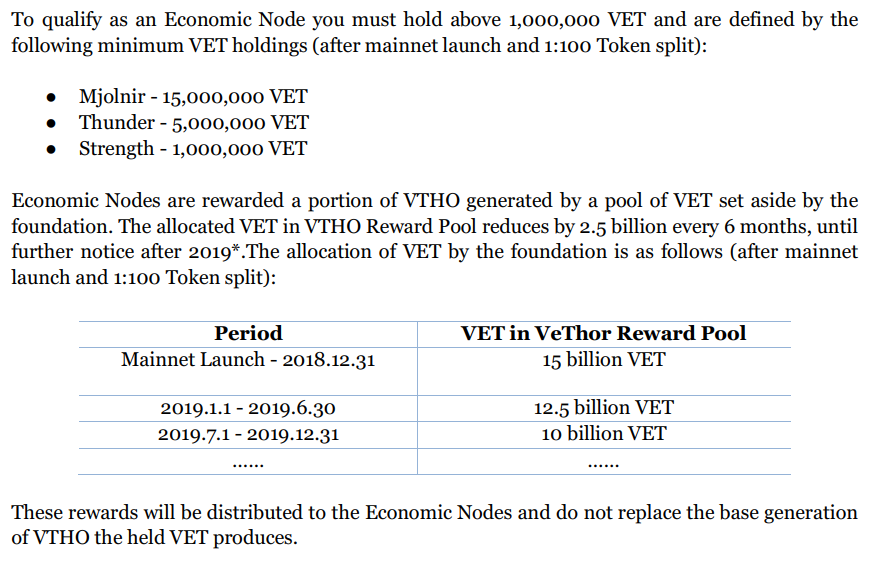

- Economy Masternodes — A VeChain Economic Node is one that offers stability to the ecosystem and act as a distribution of power and privilege within the blockchain economy. For each 10,000 VET held by a node, they represent one vote within the majority consensus. Unlike Authority Nodes, Economic Nodes do not produce blocks and ledger records.

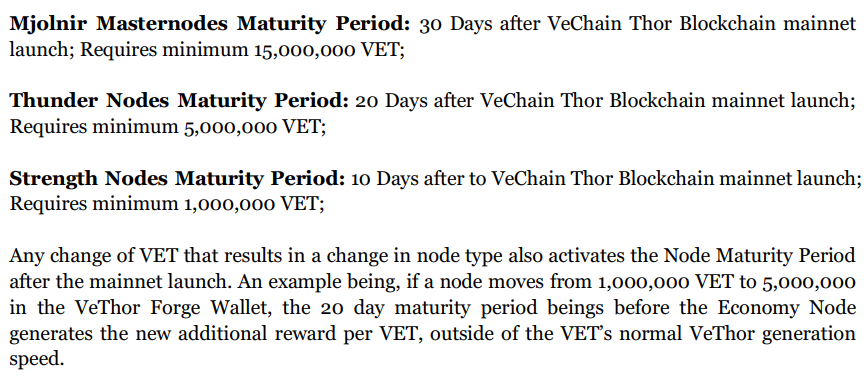

6. Node Maturity Period — “Node Maturity Period” is a term used in the VeChain ecosystem, meaning once a wallet has the amount needed to qualify for a certain node and the corresponding amount stored in ‘VeThor Forge’, the built-in function in VeChain wallet, then the Node Maturity Period starts to count.

X-Nodes

X-Nodes are an additional pool of VET set aside for early supporters. To see the perks offered to early supporters please view the X-Node release.

VeChainThor CORE

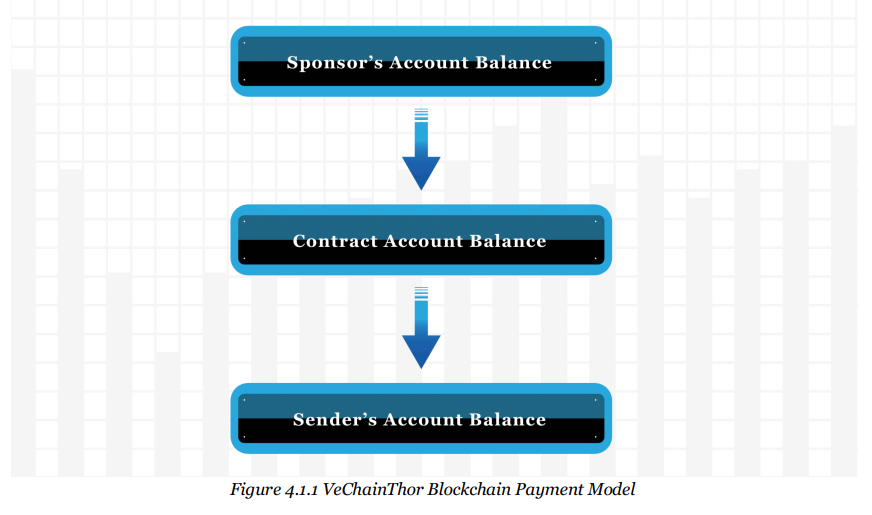

Payment Model

- VeChainThor Blockchain transactions can possibly be paid by three different parties. From bottom to top, they are the transaction sender, the transaction recipient and the sponsor of the smart contract.

- TL;DR — At most of the cases, you won’t necessarily be paying for the transaction. 😉

- It enables an enterprise to manage its multiple DApps more effectively and efficiently since it can use a master account to sponsor multiple smart contracts and it simply needs to ensure that the master account has sufficient funds to pay for transaction fees.

Transaction Model

- TransactionID feature to send multiple transactions at once without the risk of replay attacks.

- BlockRef function to define the height of the block you want your transaction to fall to.

- Option to “utilize your local computatinal power” to increase the gas price, rather than paying for higher fees and gas wars, as seen in ETH.

Proof of Authority Consensus

“It takes twenty years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” — Warren Buffett

The main characteristics of the PoA protocol implemented in VeChainThor Blockchain:

1. Low requirement of computational power;

2. No requirement of communication between AMs (Authority Masternodes) to reach consensus;

3. System continuity independent of the number of available genuine AMs;

The primary feature here is Block validator Randomization to prevent 51% attack and maintain system continuity. I won’t go into technicals here, but the thing to note is, next block validator’s sequence can be randomized both algorithmically and deliberately by the Foundation to increase the unpredictability hence, making it more difficult for attacker(s) to find out who is responsible for producing a number of consecutive blocks at a time relatively far from now.

Architecture and Applications Development

The ground rule of VeChain technology development is to be driven by applications. VeChain believes that use cases drive products and products drive technology development — NOT the other way around.

Four-layer Technology Stack of VeChainThor Platform

- TouchingPoints to digitize the physical world using NFC and RFID chips to digitize products and sensors to capture environmental, inertial, gas and location information through sensors.

- Connection: the connection stack transmits the data captured through the sensor stack. These two stacks form the IoT technology portfolio in VeChainThor platform.

- Blockchain Core: Blockchain Core is responsible for carrying on the transactions and storing the data gathered through the previous stacks.

- Applications and Services: Applications and public services built into the Blockchain provide the infrastructure services to simplify and standardize application development along with common protocols and interfaces such as VeVID for KYC, VeVOT for voting, VeSCC for smart contract certification, VeSCL for the Smart Contract Library and other suites of technical protocols like side-chains, cross-chains, data feeds, oracles and so on.

TL:DR

Plethora of Core Protocols for — Security, Data Storage, Multi Transaction, Cross-chain, Interoperability, Privacy etc.,

Business Application layers containing a public service module for the VeChainThor services including VeChainThor explorer, Universal Data Audit Service, Blockchain Data Monitoring Service, Distributed Content-Addressable Storage System etc.,

and Robust VeChain Application Ecosystem including — VeBaas, VeIaas, VeSDKs, VeAudit, VeAgent, PIPS (Privacy Information Protection System) makes VeChain a formidable blockchain ecosystem in terms of mainstream Enterprise adoption that includes a sophisticated IoT+Blockchain application covering wide arrays of IoT implementations across the globe.

Technical Testing

VeChain evaluates the testing phase of any technical delivery by complying and following the well-defined procedures of professional software testing. Software should be predictable and stable to fulfil the expectations and design of the product.

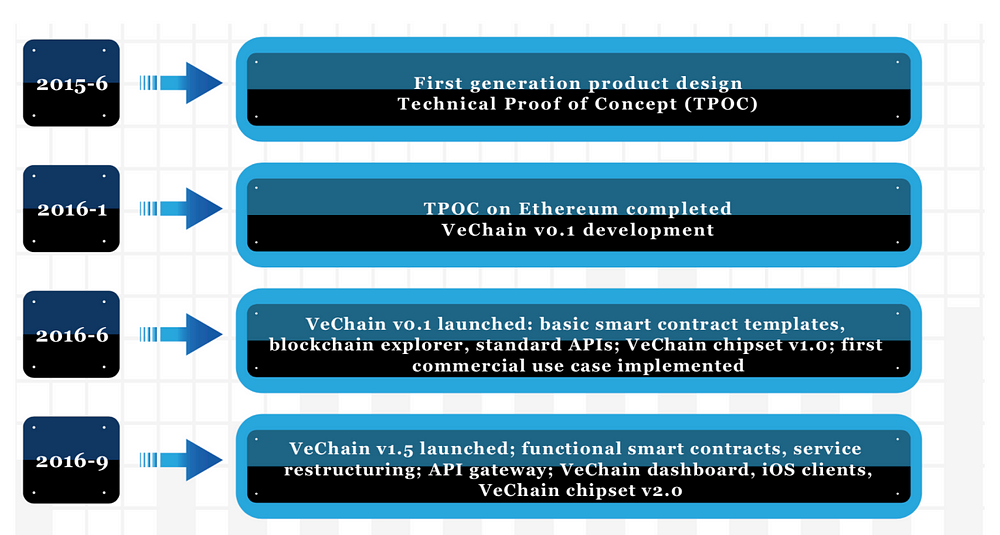

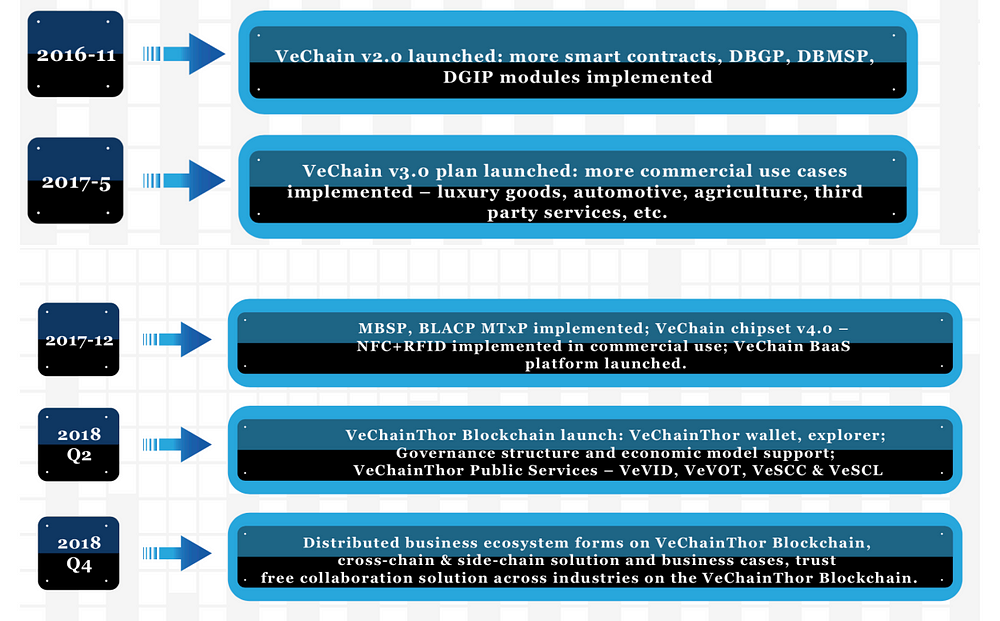

Technical Roadmap

The development of VeChainThor technology has been over two years in the making and the core guidelines have focused and will focus on three areas: applicability, standard and security.

There are a few sub-teams in VeChain Technical Department:

- Research and Development — focused on the infrastructure level of the technology, as well as the research and experiment of emerging technologies such as IoT, A.I. and so on;

- Development Delivery — develop and implement based on the driving of the Strategy Plan, Business Plan and R&D;

- Blockchain Core;

- Applications, Services and Tools;

- IoTs — TouchingPoint and Connections;

- Security; and

- Testing, deployment and maintenance.

Note: VeChain guys really need to work on their Design Department. 😉

Use Cases and Applications

The VeChainThor platform will be the carrier for this, with robust core blockchain infrastructure, matching public services and tools, and devotion from everyone in the community including the VeChain Foundation, enterprises and individuals.

- The VeChainThor platform will have an easy-to-use blockchain infrastructure for business owners and a “one-click” deployment solution so that they can easily build and manage their own blockchain nodes, smart contracts and APIs to improve their business applications.

- VeChainThor platform will be open source by end of June 2018.

- VeChain’s solution aims to build up a product traceability solution covering the life-cycle of products from the manufacturing, logistics and supply chain, retail and wholesale, after service, and even consumer engagement on blockchain for anti-counterfeiting along with IoT technologies with industries including but not limited to Fashion and Luxury, Food Safety, Automobiles (and, YES, BMW is indeed in a partnership with VeChain and will be announced later), Supply Chain — Asset Management and Risk Management, Agriculture (cooperating with PwC, China Unicom and Liaoning Academy of Agricultural Sciences), Government Affairs like Citizen Records, Votings etc. (Rest Partnership details can be found here.)

VeChain admits that “The biggest challenge the VeChain team has been facing during the use cases development and implementation in the past two years is not the technical concerns, but the business consensus of how to achieve new business models.”

This statement really sums up VeChain’s business philosophy and why I am so heavily invested in them. They are saying that the biggest challenge in this space is not with the technology, but actually getting the right partners and business models to incorporate the technology effectively. Essentially, I believe, true adoption of the tech with actual use cases is more important than having the best tech with no true adoption.

VeChain Foundation

The VeChain Foundation implements and sticks to the following principles for ecosystem development:

- The VeChain Foundation serves the purposes of a non-profit organization;

- Efficient and sustainable development; and

- Open source and sharing.

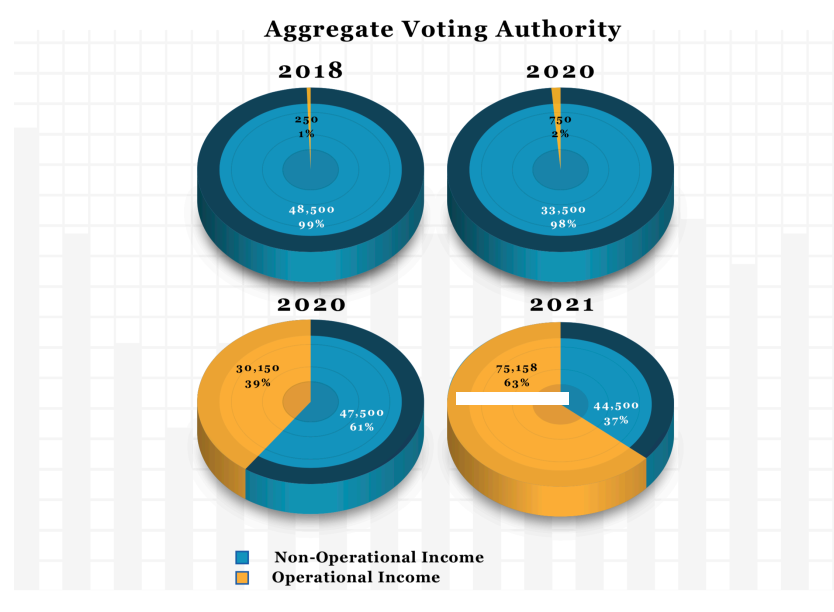

Funding Sources

The main income of the Foundation will be made up from two areas:

- Non-operating income including the initial token sale funds and returns from digital assets;

- Regular operating income, including research and development results, product sales, patent transfers or licensing, academic exchange and contribution, and so on.

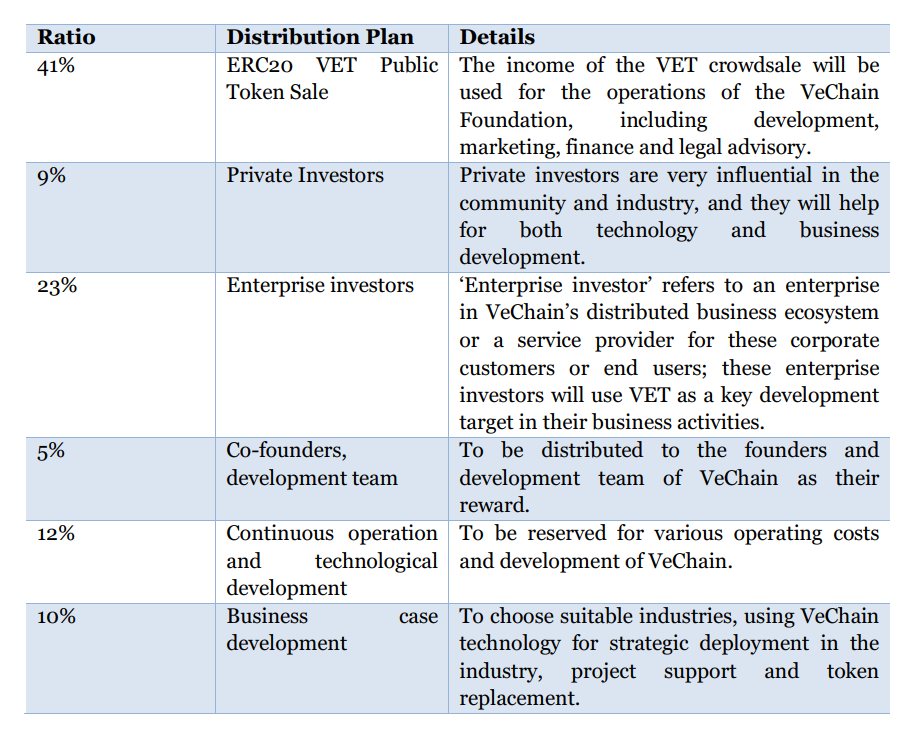

Initial Funds and Token Release

VeChain has issued in total 1 billion ERC20 VeChain Tokens (VET) on Ethereum.

There are 132,837,366.56 ERC20 VET that have been refunded and destroyed / burned under the audit of our third-party trusted institution. The results have been disclosed in public and can be checked in Ethereum’s blockchain explorer for the current ERC20 VET.

The current total supply of ERC20 VET is 867,126,344.66. After token split, the total supply of native VET will be 86,712,634,466.

The VET allocation plan is as follows:

- VeChain Foundation allocate about 5% to 10% of the funds or digital assets to setup a VeChain Incubation Program along with other venture capital funds such as Fenbushi Capital, Future Capital, and other reputable crypto funds which are continuously increasing to support blockchain projects, which are willing to develop business applications on VeChain or future technical or business partnerships.

- Professional Services

In the process of building the ecosystem, the VeChain Foundation serves as a public service provider of the VeChainThor Blockchain and receives a certain amount of digital assets or funds. For example, the VeChain Foundation can provide a professional service to traditional enterprises to ease and simplify the process of developing, building, maintaining and generally transforming their new business by using VeChainThor Blockchain. In return, the VeChain Foundation will receive a service fee in the form of digital assets, i.e. VET.

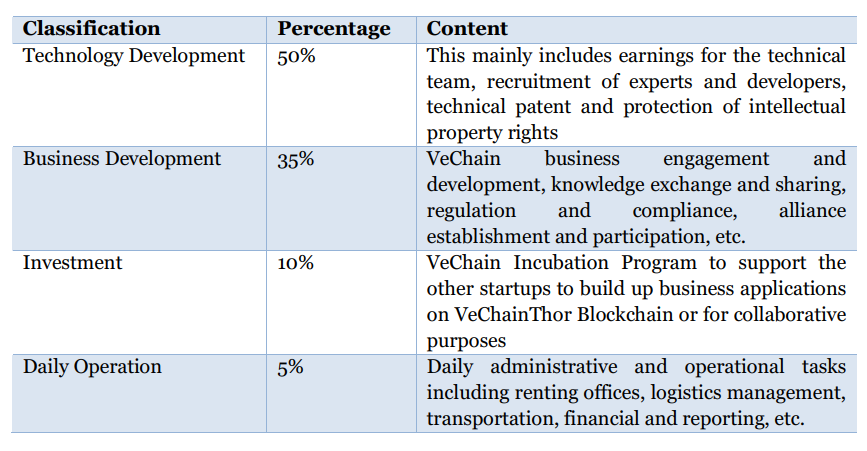

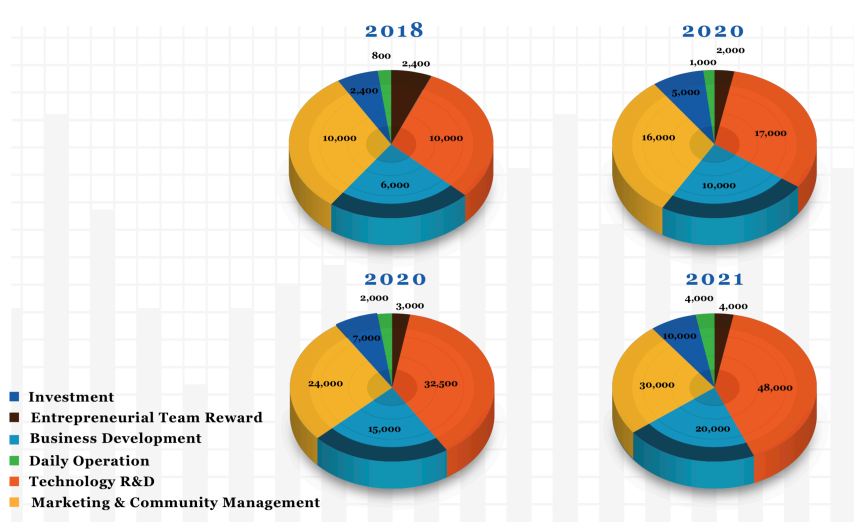

Fund Budgeting

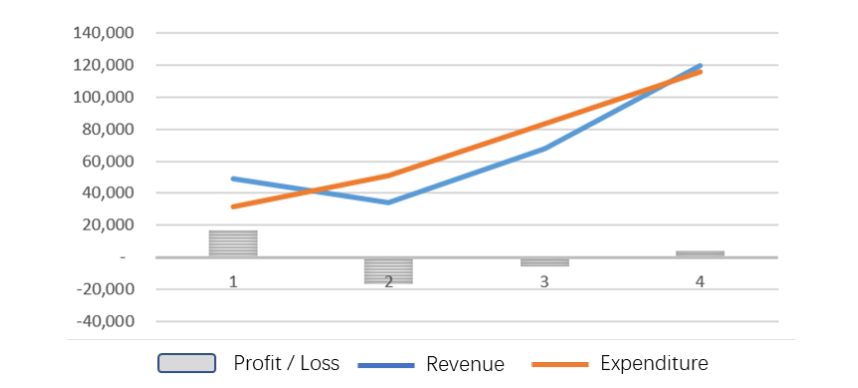

The following is the forecast for the next four years for the purpose of budget planning:

To sum up, the VeChain Foundation has obtained initial funds through ICO activities, and will take about 4 years to achieve the following:

- Growth of the VeChain Foundation. This includes headcount increasing to between 100 and 150 for both technical and business development, and business growth of 20 billion USD as “VeChain GDP” running on VeChainThor Blockchain.

- Focus on R&D and business development. A significant part of the total budget will be allocated to both technical development and business development for the ecosystem growth

- Drive value — The Foundation will not only consume initial ICO start-up funds to build up the ecosystem and create commercial value with the community, but additionally the Foundation has obtained and will obtain revenue by providing various blockchain services within the system.

- Non-profit principle. The VeChain Foundation promises not to distribute profits or dividends to the founder team, controllers or shareholders in the Foundation. The operating income, subtracted the operational expenditure, will all be allocated to the cause of the community and ecosystem development.

Fund Usage Restrictions and Financial & Implementation Reports

- The use of funds is in line with the principles of openness and transparency. The use of funds will be directed to the development of VeChain ecosystem and improvement of blockchain technology and application. This information will be disclosed to community on a regular basis.

- Each quarter, the financial team will prepare its report including financial planning and a summary of financial performance over the last quarter. The report will be released to the public after approval from the leader of Financial Units of Operational Committee.

Digital Asset Management

Following measures will be taken to ensure internal control and risk management of funds should they happen in the near future and YES, I LOVE IT. Other Blockchain Organizations must follow VeChain as a live example on fund and risk management, because extra security never hurts. (I’ll be mentioning every security measures listed on the whitpaper here, making VeChain lead by example.)

- The digital assets belonging to VeChain Foundation are supervised by Steering Committee and managed by the full-time finance team under the leader of the Operational Committee who is appointed by Steering Committee.

- A group of teams, not individual persons, are working together to operate, record and monitor use of digital assets. The digital assets belong to the VeChain Foundation so no individual, even the members from the Steering Committee have access to the digital assets. That is to say, the private keys of the digital assets wallets are stored in encrypted tokens. The passwords for the tokens are set by the authorized steering committee members, however the tokens are physically stored in the bank vault. The vault can only be accessed by a combination of three authorized persons, who have no access to the passwords for the tokens.

- Segregation of duties. This involves two layers of segregation:

a. The approval and execution duties are segregated, i.e. the person who has approval rights cannot operate the digital assets wallet.

b. The accounting and operations are segregated, i.e. accounts and digital assets operations are assigned to different persons. Each transaction needs to be reconciled. The accounting books must be reconciled to the digital assets ledger on a periodical basis. - Improving asset security. This too involves two layers of security:

a. Asset wallet designation. The Foundation has allocated digital assets to different wallets. For daily operational use, the foundation has set up the hot wallet. For a large amount of funds, they have been stored in cold wallets which are stored in a secure vault.

b. Balance of different assets. The Foundation evaluates the different values of digital assets, i.e. BTC, ETH or other tokens and adjust the portion of them on a periodical basis. It is to balance the liquidity of the tokens and in addition stabilize the value of digital assets. - Continuous monitoring. The monitoring mechanism is built to supervise the use of the digital assets. Any abnormal use of the assets will trigger an alarm so that an independent team will consider further investigation of such use.

- Business Continuity Plan (BCP) and Disaster Recovery Plan (DRP). Formal digital asset based BCP and DRP (Crypto DRP, CDRP) has been established and approved by the Steering Committee. The plans include different measures to recover digital assets or restore digital asset wallets in various emergency circumstances. These circumstances include breakdown of the hot wallet, breakdown of devices or wallet hacking or attacks. A CDRP drill is performed every quarter.

Following the best practices of risk management and internal control, the Foundation has decided to adopt a multi-signature process to ensure the safety and accuracy of asset movement, after sufficient testing on multi-signature technology. Based on the principle of independence, VeChain Foundation applies a 4/7 multi signature process for all of its significant wallets. Any new added signature or modification is subject to the approval of the Steering Committee.

Disclosure

Once a year, the VeChain Foundation will share the progress and status of the business and technical development, operations, and future plans with the community. For the financial situation of the Foundation, the public financial report will be drafted and shared quarterly, and the work of the annual audit will be disclosed.

Team Members

I don’t want to make this article too long so, I suggest you to visit VeChain’s Team Webpage to know more about their amazing stallions.

This concludes the summary of 114 pager — VeChain’s Whitepaper.

I personally believe that this white paper clearly demonstrates the ability of this company to create real value for real world applications. I strongly believe VeChain will become the world’s leader in blockchain technology and innovation unleashing the Enterprise adoption we all have been looking for a long time from other projects. As a tech enthusiast and entrepreneur, I can really appreciate their technical road map including VeKeystore, VeBaaS, VeSDKS and VeIaaS. There is no doubt in my mind that VeChain will be on the forefront of Enterprise Adoption and innovation in Blockchain Technologies for years to come.

If you liked this post, please hold the clap 👏🏼 button below for few seconds to show your support! Also, feel free to comment and give any kind of feedback. Don’t forget to follow us! Also, don’t forget to join our Telegram Channel to stay on top of Everything Blockchain.

Disclaimer: This post is for educational and informational purposes only and not to be considered as an investment advice. Information contained herein is obtained from different sources and are believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation — we are not financial advisors nor do we give personalized advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.You should consult with a financial advisor or other professional to determine what may be best for your individual needs and risk tolerance. Always do your own research.